SumZero

•

17th February 2022

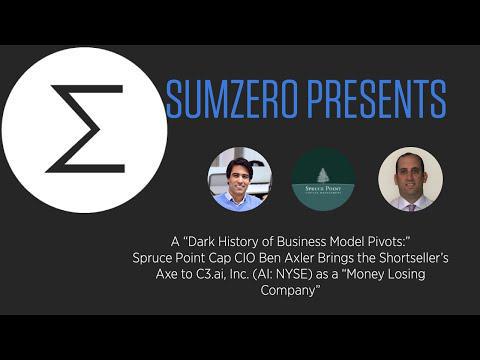

Spruce Point Capital Shorts C3.ai, Inc (AI: NYSE), Calling it a 'Money Losing Company'

On Wednesday February 16th 2022, SumZero CEO Divya Narendra sat down for a live conversation with Spruce Point Capital CIO, Ben Axler, to discuss the thesis behind their research report short C3.ai, Inc. (AI: US), which they say presents serious downside risks to investors.

The report, which calls AI a "money losing company," cites a "revolving door" in its CFO position and a "dark history of business model pivots," while adding that "challenges in product adoption and significant salesforce turnover make it unlikely that C3.ai will meet aggressive analyst estimates." The report also points out that Spruce Point could not "find a single AI thematic ETF that holds C3.ai as a top 10 position in its fund," and that "retail investors appear to be the biggest shareholders being baited by these optimistic (price targets held by other analysts)."

For more information on Spruce Point Capital's thesis on c3.ai (AI: NYSE) go to https://www.sprucepointcap.com/c3-ai-inc/ and follow them on Twitter: https://twitter.com/sprucepointcap.

For more fundamental-driven investment research on stocks as well as crypto, please join https://www.SumZero.com.

00:00 Start

00:10 Divya Narendra introduction

00:40 Ben Axler introduction to thesis short C3.ai (AI: NYSE)

01:13 AI founded in 2009 by Tom Siebel

01:25 History of AI’s various business models

02:00 Reliance on Baker-Hughes for revenue

02:10 Overview of position

02:50 AI’s actual business

03:19 “People still don’t seem to know” what AI provides

03:43 AI’s customer base includes 3M, Baker Hughs, Caterpillar, utilities companies

04:13 Complexity of product “one of its limiting factors”

04:55 Issues w/ existing customer relationships

05:29 AI’s definition of “customer” and potential overstatement (slides 25 - 27)

06:00 Challenges selling product leading to contract modifications

06:20 Baker-Hughes deal summary (slide 35)

07:09 “A marriage that’s just not working”

07:45 Wall Street revenue estimates too high, Spruce Point sees 40-50% downside target

07:55 Channel checks in research

08:21 CFO turnover (slide 63)

08:36 One departing CFO forfeit $20M in stock options

08:57 Concerns raised about current CFO

09:18 “Management in Flux;” executives departing (slide 68)

09:54 Bull argument for stock

10:06 “Can’t think of any (bull argument), other than it’s down a lot.”

10:40 Claims of exaggerated TAM (slide 20)

10:52 30% of revenue coming from one customer

11:09 Conflicting statements about product development costs

11:30 Conflicting statements about sales cycle

12:10 Stock down more than 70% in a year

12:20 Cash burn

12:39 Competitors

13:50 Details on TAM statements

14:11 $260M revenue company in $270B market?

15:00 Spruce Point targeting questionable companies going public

16:28 Customer base, government contracts (slide 27)

17:12 Valuations

17:40 Debt, operating lease with Google (slide 60)

18:00 Company shrinking due to employee turnover

18:28 Discounted multiple on-Baker-Hughes business

18:43 Spruce Point sees 40 - 50% downside

19:14 Questions about partnerships, 10-year, $103M lease with Google (slide 60)

20:45 Cash flow/burn

20:55 Governance - dual class stock

21:32 Two board directors w/ ties to Makena Capital (slide 74); other possible conflicts of interest

22:18 Dual class status limits institutional owners, retail investors could be targeted

23:55 Average analyst price target $53

24:14 Company in “organizational disarray”

24:35 Stock buyback

25:40 Potential risks

27:20 Final comments

27:30 AI’s accounting

28:05 Are unbilled receivables being used to beat quarterly guidance? (Slide 43)

29:45 More questions raised about Baker-Hughes partnership

30:05 Summary