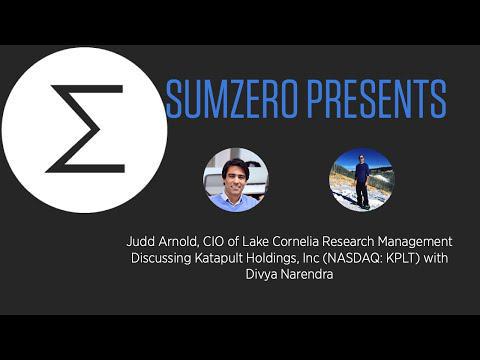

SumZero

•

4th August 2021

SubPrime Bull: Fund Manager Judd Arnold Says KPLT's "land grab" in BNPL is a BUY NOW

8/16/21 Update: LCRM's Judd Arnold reports that he has closed his position on KPLT: details are here https://sumzero.com/pro/research/ideas/19975.

Lake Cornelia Research Management CIO discusses his bullish thesis on Katapult Holdings Ltd. (US: KPLT) with SumZero CEO Divya Narendra. Read Judd's 60 page memo for free with a SumZero login here: https://sumzero.com/pro/research/ideas/19975

Presentation slides available here: https://www.icloud.com/iclouddrive/09I_mT6N3SVvX2XSbdQcRSZ3A#LCRM_KPLT_CALL_8-2-21

For more fundamentally-driven investment research on stocks as well as crypto, please join https://www.SumZero.com.

00:00 Start

00:10 Divya Narendra intro

00:40 Buy Now, Pay Later (BNPL) trend in consumer spending

00:50 Square (US: SQ) acquisition of AfterPay

01:05 Jargon

01:24 Judd Arnold intro and discussion of BNPL and subprime financing space

01:45 BNPL segmented across verticals

02:13 "Pay 4", Average Order Value, (AOV) and BNPL (Slide 7)

03:15 Advantages of financing over credit cards

03:33 Volume of receivables

03:55 Square and the AfterPay deal

04:12 AfterPay's penetration in the Australian market

04:26 KPLT's higher AOV

04:37 Competition from Acima and Progressive (US:PRG)

05:02 Market demographics, subprime credit customers

05:11 Wayfair (US: W), furniture, and auto parts

05:29 7-month average on KPLT leases

07:18 Savings relative to compounded credit card interest

07:43 How defaults are handled

09:10 How payments are handled

09:44 The two things American consumers can't live without

10:44 BNPL and bad debt expense

11:01 Direct lender OPFI's 35 - 40% credit losses

11:20 KPLT's 3% credit losses

11:40 Is KPLT pure fintech? (Slide 11)

12:06 PRG has over 2000 employees

12:18 KPLT has 80-90 employees

12:43 KPLT partnership with Affirm (US: AFRM)

14:11 KPLT's free cash flow (Slide 20)

15:30 How KPLT manages client credit risk

16:00 Credit data granularity "beyond FICO scores"

16:57 Algorithms bidding on extending credit to Wayfair customers

17:10 "KPLT winning on two fronts"

17:30 KPLT bidding aggressively on existing customers

18:10 KPLT holds data for 1.5M subprime credit customers

18:20 KPLT algos faster to respond than competition

19:05 Integration, diversification, partnerships

19:25 Quarterly revenue determinants

21:35 Addressing concern's about Wayfair's '21 Q2 (Slide 17)

22:18 "Wayfair risk isn't about the quarter" (Slide 16)

22:45 KPLT's partnership with Wayfair is an advantage

23:25 Total addressable market

23:54 Customer acquisition potential (Slide 15)

24:48 Most small merchants only have one subprime solution

25:40 "This is all a land grab right now"

27:15 PRG's 3 biggest customers

27:43 BNPL market is growing

29:20 KPLT history, founders, and early investors

31:58 KPLT's relationship with CURO Group (US:CURO)

32:16 KPLT 30-40% of CURO's market cap

32:26 How KPLT went public: SPAC, PIPE investors, etc

36:16 Recent dip and free cash flow

39:50 KPLT's investments in growth

41:00 Understanding KPLT's business (Slide 20)

41:41 Biggest threats to KPLT

42:31 Waterfall partnership with AFRM (Slide 9)

43:53 Barriers to entry in subprime

45:54 Macro-risks to BNPL in COVID-19 era

48:20 Square/AfterPay and KPLT's recent performance

49:35 PIPE unlock likely a non-event

50:45 Q2 earnings expectations (Slide 14)

52:03 Possible catalysts

55:15 Target price by end of 2022

56:45 Kafene

58:14 Closing remarks

Copyright 2021 SumZero Inc (www.sumzero.com). No portion of this video - including any excerpted audio - may be used without express written permission from the copyright holders.